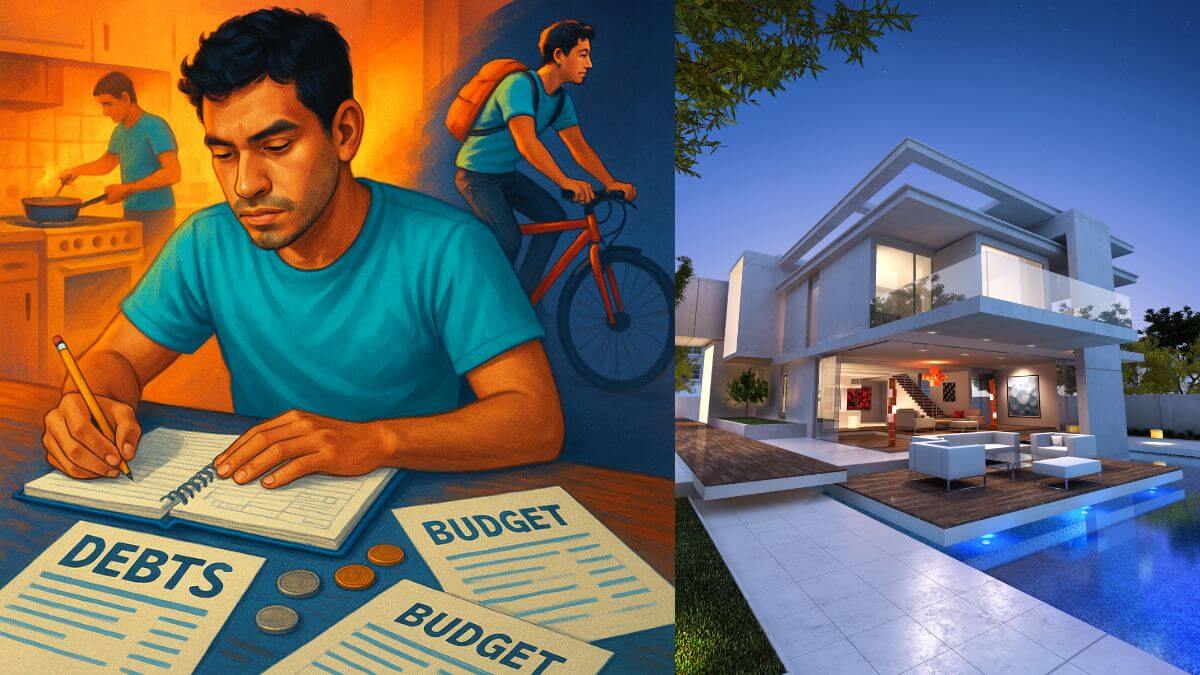

At first glance, getting out of debt while earning little might seem impossible. However, with organization, discipline, and the right strategies, it becomes entirely possible. In the article below, we will show you step-by-step how to get out of debt even with a low income. This topic is crucial, as it affects millions of people and not only harms their budget but also their mental health and relationships. If you want to know how to get out of debt intelligently, continue reading.

What is How to Get Out of Debt?

The question “how to get out of debt” is not just a common inquiry but a topic that encompasses financial education, behavioral change, and careful planning. The key is to analyze your current income source, debt holdings, and devise a clear plan to pay it off as quickly as possible. Paying bills, in this case, is not a financial issue; it’s about regaining control over your life. In short, those who investigate how to get out of debt desire freedom, peace, and tranquility.

you can love too: How to Shop Smart and Save Money

Benefits of Getting Out of Debt

When you learn how to get out of debt, multiple benefits follow: emotional relief, better family relationships, improved credit score, restored access to purchasing power, and future prospects. In other words, getting out of debt is the solution to immediate problems and the possibility of not repeating them in the future.

Practical Strategies: How to Use the Term “How to Get Out of Debt”?

Below is a step-by-step guide on how to get out of debt even while earning little:

- Financial diagnosis: List all debts, amounts, deadlines, and interest rates. Determine an exact average income.

- Quitting debts isn’t exactly a fun thing to do, but it’s possible with willpower and these tactics:

- Cut unnecessary expenses.

- Negotiate your debts and propose viable agreements to creditors.

- Prioritize debts with high-interest rates, such as credit cards and overdrafts.

- Snowball technique: Pay off smaller debts first and gradually move to larger ones.

- Seek extra income through sales, freelancing, and odd jobs.

- Control spreadsheet: Track every penny that comes in and goes out.

The strategies for getting out of debt are fundamental, but persistence and commitment are crucial.

The Beginning of Everything: Mindset Shift and Turnaround

Knowing how to pay off debt starts with a change in mindset. First, it’s necessary to change the way you think. Many people get into debt due to wrong habits and beliefs, such as buying to please others or living beyond their means. When the mindset changes, we recognize that small steps today produce gigantic changes in the future: wait, save, and plan first.

This article is crucial, take a look: How to Save Money on Everyday Purchases

Involving the Family: Everyone Has to Help

It’s easier to get out of the red when you’re not alone. Talk openly about the reasons behind your spending cuts. Ask all family members to make sacrifices, from reducing the electricity bill and not wasting resources to finding creative ways to increase family income.

Conclusion

Getting out of debt while earning little is possible and begins with a firm decision. As long as you apply the right strategies, change your mindset, and involve your family, you will not only pay off your debts but also build a healthier financial life. Always remember that financial education is synonymous with freedom. Therefore, it doesn’t matter how much money you earn, but how you manage it. Now that you know how to get out of debt, start today.

Frequently Asked Questions

Is it possible to get out of debt earning a minimum wage?

Yes, it is possible. Just get organized, have control over your expenses, and count on small sources of reserve money that help reverse the situation.

What is the best way to negotiate debts?

Contact your creditors, propose agreements that align with your reality, and ask for discounts on interest and fees.

What should be done first: save or pay debts?

It depends a lot on your financial situation. Ideally, you should be able to do both, but if it’s urgent, pay off debts with high interest rates, but maintain a reserve.

Is it worth taking out loans to pay off debts?

Only if they have much lower interest rates than what you already have and if you guarantee that you will be able to pay the new commitment.

How to avoid new debts after getting rid of them?

Make a budget, control your spending, avoid impulse buying, and maintain a financial reserve for emergencies.

How do I know if I’m really in debt?

If you can’t pay your bills, keep missing credit card payments, or maintain balances on revolving credit accounts, you are in debt.

On Trilha Riqueza, you’ll find effective strategies, investment tips, and a complete roadmap to navigate the path to wealth and achieve your financial goals.