5 Free Apps to Control Your Financial Life in 2025

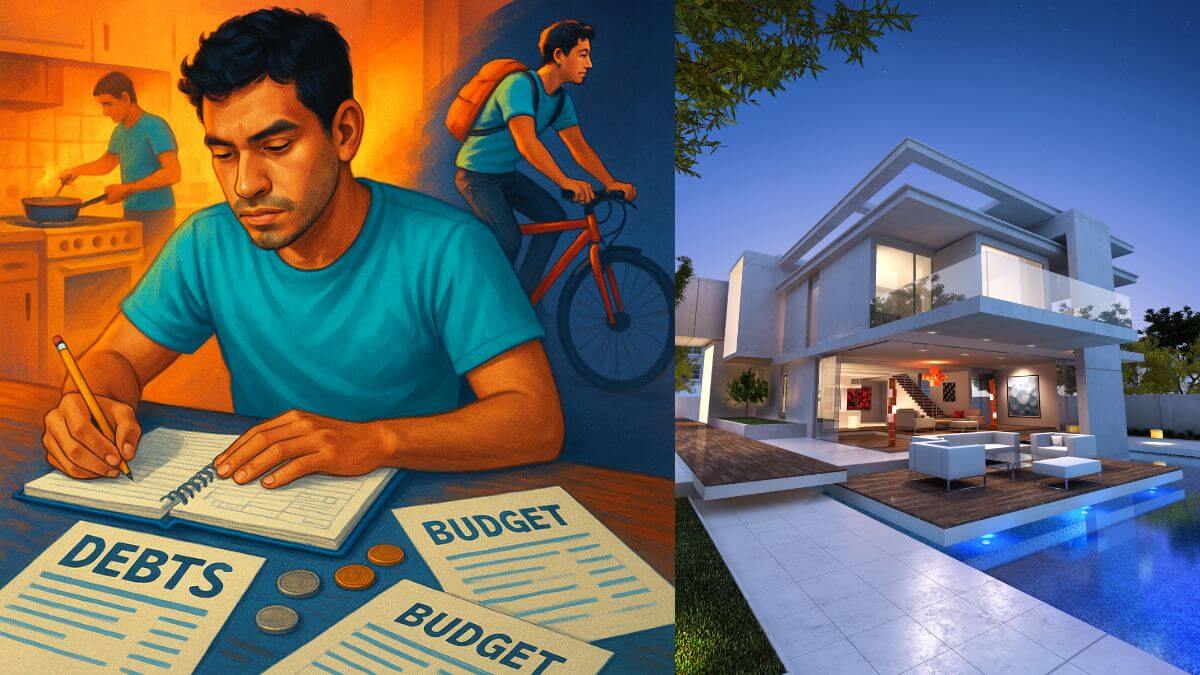

In today’s fast-paced world, managing your financial life manually with spreadsheets or paper may not be the most efficient approach. Financial apps can offer you an easy, accessible, and organized way to monitor your finances in real-time.

Continue Reading